How We Handle Cheque Bounce Cases?

At SNS Legal Aid, we provide expert legal assistance for cheque bounce cases, ensuring swift legal action and financial recovery. A cheque bounce occurs when a bank refuses to honor a cheque due to insufficient funds, signature mismatch, or other technical reasons. Under Section 138 of the Negotiable Instruments Act, 1881, cheque bounce cases are considered criminal offenses punishable with imprisonment or fines.

Our approach includes:

- Legal Consultation & Case Evaluation – Understanding the reason for cheque dishonor and available legal remedies.

- Issuing Legal Notices – Sending a demand notice to the drawer within the prescribed legal timeframe.

- Filing a Complaint – Initiating legal action under Section 138 of the Negotiable Instruments Act if payment is not made.

- Criminal & Civil Proceedings – Handling both criminal cases (for punishment) and civil suits (for financial recovery).

- Settlement & Negotiation – Assisting in out-of-court settlements to expedite payment recovery.

- Bankruptcy Proceedings – Taking legal steps if the defaulter claims insolvency.

- Debt Recovery Mechanisms – Exploring options under the Insolvency and Bankruptcy Code (IBC), 2016, and other laws.

Laws & Acts Involved in Cheque Bounce Cases

- Negotiable Instruments Act, 1881 (Section 138-142) – Governs cheque dishonor and prescribes criminal penalties.

- Indian Penal Code, 1860 (IPC Sections 406, 420) – Deals with cheating and criminal breach of trust in financial matters.

- Code of Criminal Procedure, 1973 (CrPC) – Governs procedural aspects of cheque bounce cases.

- Insolvency and Bankruptcy Code, 2016 – Provides mechanisms for recovery from insolvent defaulters.

- The Civil Procedure Code, 1908 – Governs civil suits for financial recovery.

Our Legal Services for Cheque Bounce Cases

✅ Drafting & Sending Legal Notices for cheque dishonor

✅ Filing complaints under Section 138 of the Negotiable Instruments Act

✅ Criminal litigation against the defaulter

✅ Civil suit for cheque amount & compensation

✅ Assisting with settlement negotiations

✅ Execution of court orders for cheque recovery

✅ Legal assistance in insolvency & bankruptcy claims

Frequently Asked Questions (FAQs)

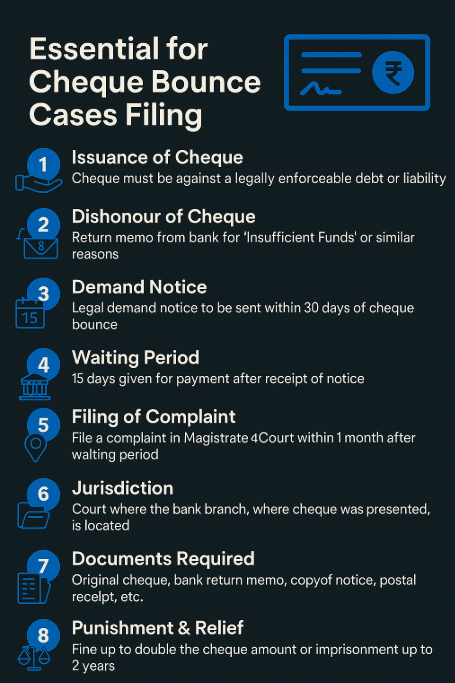

You can send a legal notice to the issuer within 30 days of receiving the bounce memo. If payment is not made within 15 days, a complaint can be filed under Section 138 of the Negotiable Instruments Act, 1881.

The law prescribes up to 2 years of imprisonment and/or a fine up to twice the cheque amount under Section 138.

Cheque bounce cases are handled in fast-track courts, typically taking 6-12 months, but timelines may vary based on jurisdiction and court workload.

Yes, the matter can be settled through negotiation or a compromise agreement at any stage of the legal proceedings.

Yes, you can file a criminal complaint under Section 138 and a civil suit for recovery of the cheque amount.

If the drawer is declared insolvent, recovery can be sought under the Insolvency and Bankruptcy Code, 2016.

Yes, if a cheque issued by a company bounces, both the company and the authorized signatory (Director or Officer) can be held liable.

If a cheque issued as security is dishonored, legal action can still be taken if the intent to defraud is established.

Ensure sufficient funds, verify signature consistency, and cross-check the details before issuing a cheque.

We provide:

- Drafting & sending legal notices for cheque dishonor

- Filing criminal complaints under Section 138

- Court representation for cheque recovery

- Negotiation & settlement of disputes

- Legal assistance in insolvency & bankruptcy matters